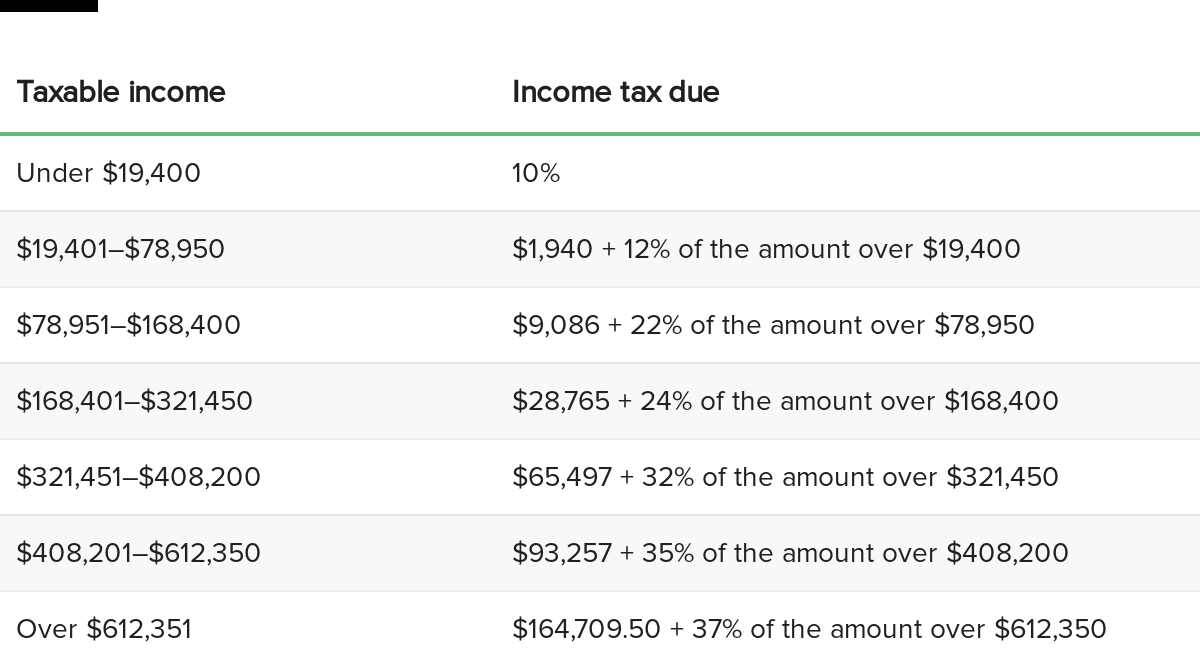

Retirement Tax Brackets 2019 . see current federal tax brackets and rates based on your income and filing status. You pay tax as a percentage of. The top marginal income tax rate of 37 percent will hit taxpayers with taxable income of $510,300 and higher for single filers and $612,350 and higher for married couples filing jointly. in 2019, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (tables 1). Find out how your taxes are affected for the new year. (1) net investment income, or (2) magi in excess of $200,000 for single filers, or head of households,. 3.8% tax on the lesser of: remember, the 2019 tax brackets impact your strategy for everything from retirement savings to your charitable donations, handling capital gains. here's a look at the 2019 tax brackets.

from brokeasshome.com

The top marginal income tax rate of 37 percent will hit taxpayers with taxable income of $510,300 and higher for single filers and $612,350 and higher for married couples filing jointly. (1) net investment income, or (2) magi in excess of $200,000 for single filers, or head of households,. here's a look at the 2019 tax brackets. see current federal tax brackets and rates based on your income and filing status. remember, the 2019 tax brackets impact your strategy for everything from retirement savings to your charitable donations, handling capital gains. You pay tax as a percentage of. Find out how your taxes are affected for the new year. in 2019, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (tables 1). 3.8% tax on the lesser of:

Irs Withholding Tax Tables 2019

Retirement Tax Brackets 2019 You pay tax as a percentage of. in 2019, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (tables 1). remember, the 2019 tax brackets impact your strategy for everything from retirement savings to your charitable donations, handling capital gains. 3.8% tax on the lesser of: here's a look at the 2019 tax brackets. You pay tax as a percentage of. see current federal tax brackets and rates based on your income and filing status. Find out how your taxes are affected for the new year. The top marginal income tax rate of 37 percent will hit taxpayers with taxable income of $510,300 and higher for single filers and $612,350 and higher for married couples filing jointly. (1) net investment income, or (2) magi in excess of $200,000 for single filers, or head of households,.

From theivyag.com

What Happens In Retirement When Pushes You Into The Next Tax Retirement Tax Brackets 2019 (1) net investment income, or (2) magi in excess of $200,000 for single filers, or head of households,. Find out how your taxes are affected for the new year. see current federal tax brackets and rates based on your income and filing status. here's a look at the 2019 tax brackets. remember, the 2019 tax brackets impact. Retirement Tax Brackets 2019.

From ryteicon.weebly.com

Us federal tax brackets for 2019 ryteicon Retirement Tax Brackets 2019 Find out how your taxes are affected for the new year. 3.8% tax on the lesser of: see current federal tax brackets and rates based on your income and filing status. remember, the 2019 tax brackets impact your strategy for everything from retirement savings to your charitable donations, handling capital gains. here's a look at the. Retirement Tax Brackets 2019.

From www.financialsamurai.com

Shifting Retirement Assets From TaxDeferred To TaxNow By 2026 Retirement Tax Brackets 2019 in 2019, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (tables 1). here's a look at the 2019 tax brackets. see current federal tax brackets and rates based on your income and filing status. Find out how your taxes are affected for the new year.. Retirement Tax Brackets 2019.

From www.aotax.com

Understanding the New 2019 Federal Tax Brackets And Rates Retirement Tax Brackets 2019 in 2019, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (tables 1). see current federal tax brackets and rates based on your income and filing status. The top marginal income tax rate of 37 percent will hit taxpayers with taxable income of $510,300 and higher for. Retirement Tax Brackets 2019.

From www.aol.com

Here's how the new US tax brackets for 2019 affect every American Retirement Tax Brackets 2019 here's a look at the 2019 tax brackets. 3.8% tax on the lesser of: You pay tax as a percentage of. Find out how your taxes are affected for the new year. in 2019, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (tables 1). . Retirement Tax Brackets 2019.

From www.financestrategists.com

Retirement Tax Brackets Definition, Types, Factors, & Strategies Retirement Tax Brackets 2019 here's a look at the 2019 tax brackets. in 2019, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (tables 1). (1) net investment income, or (2) magi in excess of $200,000 for single filers, or head of households,. 3.8% tax on the lesser of: You. Retirement Tax Brackets 2019.

From rethinking65.com

Your Retirement Tax Bracket Might Be Higher Than You Think Rethinking65 Retirement Tax Brackets 2019 Find out how your taxes are affected for the new year. The top marginal income tax rate of 37 percent will hit taxpayers with taxable income of $510,300 and higher for single filers and $612,350 and higher for married couples filing jointly. You pay tax as a percentage of. remember, the 2019 tax brackets impact your strategy for everything. Retirement Tax Brackets 2019.

From www.pinterest.com

IRS released new tax brackets for 2019. Learning to do your tax returns Retirement Tax Brackets 2019 (1) net investment income, or (2) magi in excess of $200,000 for single filers, or head of households,. You pay tax as a percentage of. in 2019, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (tables 1). remember, the 2019 tax brackets impact your strategy for. Retirement Tax Brackets 2019.

From thecollegeinvestor.com

2019 Federal Tax Brackets What Is My Tax Bracket? Retirement Tax Brackets 2019 in 2019, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (tables 1). (1) net investment income, or (2) magi in excess of $200,000 for single filers, or head of households,. remember, the 2019 tax brackets impact your strategy for everything from retirement savings to your charitable. Retirement Tax Brackets 2019.

From www.financestrategists.com

Retirement Tax Brackets Definition, Types, Factors, & Strategies Retirement Tax Brackets 2019 in 2019, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (tables 1). You pay tax as a percentage of. remember, the 2019 tax brackets impact your strategy for everything from retirement savings to your charitable donations, handling capital gains. (1) net investment income, or (2) magi. Retirement Tax Brackets 2019.

From www.westernstatesfinancial.com

2019 Federal Tax Brackets, Tax Rates & Retirement Plans Western Retirement Tax Brackets 2019 in 2019, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (tables 1). You pay tax as a percentage of. Find out how your taxes are affected for the new year. 3.8% tax on the lesser of: remember, the 2019 tax brackets impact your strategy for. Retirement Tax Brackets 2019.

From www.financialsamurai.com

How Much Does A Family Need To Make To Live In An Expensive City? Retirement Tax Brackets 2019 in 2019, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (tables 1). remember, the 2019 tax brackets impact your strategy for everything from retirement savings to your charitable donations, handling capital gains. Find out how your taxes are affected for the new year. (1) net investment. Retirement Tax Brackets 2019.

From brokeasshome.com

Irs Withholding Tax Tables 2019 Retirement Tax Brackets 2019 The top marginal income tax rate of 37 percent will hit taxpayers with taxable income of $510,300 and higher for single filers and $612,350 and higher for married couples filing jointly. remember, the 2019 tax brackets impact your strategy for everything from retirement savings to your charitable donations, handling capital gains. here's a look at the 2019 tax. Retirement Tax Brackets 2019.

From www.grfcpa.com

YearEnd Tax Planning Moves for Small Businesses GRF CPAs & Advisors Retirement Tax Brackets 2019 3.8% tax on the lesser of: in 2019, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (tables 1). here's a look at the 2019 tax brackets. remember, the 2019 tax brackets impact your strategy for everything from retirement savings to your charitable donations, handling. Retirement Tax Brackets 2019.

From winningsilope.weebly.com

Tax brackets 2019 winningsilope Retirement Tax Brackets 2019 see current federal tax brackets and rates based on your income and filing status. (1) net investment income, or (2) magi in excess of $200,000 for single filers, or head of households,. remember, the 2019 tax brackets impact your strategy for everything from retirement savings to your charitable donations, handling capital gains. Find out how your taxes are. Retirement Tax Brackets 2019.

From www.purposefulfinance.org

IRS 2019 Tax Tables, Deductions, & Exemptions — purposeful.finance Retirement Tax Brackets 2019 The top marginal income tax rate of 37 percent will hit taxpayers with taxable income of $510,300 and higher for single filers and $612,350 and higher for married couples filing jointly. (1) net investment income, or (2) magi in excess of $200,000 for single filers, or head of households,. see current federal tax brackets and rates based on your. Retirement Tax Brackets 2019.

From www.portebrown.com

What Do the 2019 CostofLiving Adjustments Mean for You? Retirement Tax Brackets 2019 here's a look at the 2019 tax brackets. 3.8% tax on the lesser of: The top marginal income tax rate of 37 percent will hit taxpayers with taxable income of $510,300 and higher for single filers and $612,350 and higher for married couples filing jointly. Find out how your taxes are affected for the new year. see. Retirement Tax Brackets 2019.

From laptrinhx.com

How to Calculate Your Tax Bracket During Retirement LaptrinhX / News Retirement Tax Brackets 2019 Find out how your taxes are affected for the new year. here's a look at the 2019 tax brackets. see current federal tax brackets and rates based on your income and filing status. in 2019, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (tables 1).. Retirement Tax Brackets 2019.